Project Overview

As of 2023, one in eight Washington children lived in poverty. To address this, Washington’s state legislature set aside funding in the 2023-2025 Operating Budget for studies on child benefit policies. The goals of the directive were to provide legislators with information and recommendations on fruitful avenues for policy reform. The Washington State Department of Children, Youth, and Families (DCYF) contracted with MEF Associates for this work, to explore possible additions or reforms to child benefit policies to better address child poverty.

MEF produced three internal, interim reports: 1) a literature review; 2) interviews with experts, legislative analysis, and document reviews of national initiatives and 3) current programs and initiatives within Washington. The work culminated in a final report to the legislature, DCYF, and the Governor’s office, synthesizing the findings from these prior reports. Washington legislators and government officials have shown substantial commitment to reducing poverty in the state, and the report builds past efforts, lessons learned, and publications from many experts and practitioners.

The report presents recommendations relevant for Washington legislators, policymakers, advocates, and funders. It can also serve as a starting point for other states considering similar changes to their public benefits. MEF was the sole contractor for this project.

Policy Options and Feasibility Evaluation

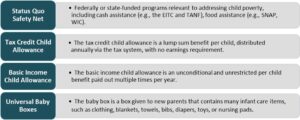

MEF, in collaboration with DCYF, identified the four policy options to explore in response to the legislative directive.

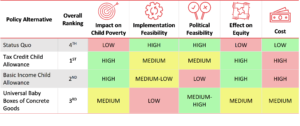

MEF used a policy analysis framework to analyze the feasibility of each of the four policy options to reduce child poverty. We assessed each policy against five criteria related to the likelihood of a given policy’s adoption and success. These criteria were 1) impact on child poverty, 2) implementation feasibility, 3) political feasibility, 4) effect on equity and 5) cost. We then ranked the policies in comparison to one another according to their potential to reduce child poverty in Washington State.

Findings

Key findings

- There is no single solution to reducing child poverty, but our analysis finds that a child allowance is the most likely policy to meaningfully reduce child poverty in Washington, either structured as a tax credit or as a basic income. Both would also reduce racial and ethnic disparities in child poverty and its consequences.

- A tax credit approach is our top ranked policy as we found it to be easier to implement, more likely to be politically feasible, and likely lower cost to administer than a basic income child allowance.

- Because of their large benefit amounts, both child allowance programs are substantially more costly than a universal baby box program or the status quo safety net, but the latter are unlikely to meaningfully reduce child poverty.

MEF produced a policy matrix displaying the ratings of each of the policies across the five evaluative criteria, highlighting the benefits and tradeoffs of each of the policies.

Recommendations for Policymakers

We presented eight recommendations based on our work, offering guiding principles that policymakers can apply when designing and evaluating future programs. We believe the recommendations and the report can be useful in considering anti-poverty policies beyond those explored.

- Benefits should be as generous as possible and come with minimal use restrictions. We recommend that any expansion to the safety net includes generous benefit amounts. Benefits should have minimal restrictions on how they can be used.

- When targeting policies, focus on those who stand to benefit the most. Consider targeting benefits to children in the 0-5 age range or providing larger benefit amounts for this group. Design eligibility criteria to prioritize families with no income and do not condition benefits on parents being employed.

- Use a broad definition of poverty. In defining eligibility based on income, consider using broader definitions of poverty, like the Self-Sufficiency Standard, which calculates the real cost of basic needs based on region, family composition, and ages of children.

- Streamline access to benefits by improving data systems, consolidating application processes, and minimizing administrative burdens on applicants.

- Reduce program benefits gradually to prevent sudden eligibility drop offs and avoid interactions with other benefits. When setting upper income limits on eligibility, benefit amounts should phase out gradually to prevent hard drop offs. Design the benefits so receiving them does not interact with eligibility for other benefits.

- Engage both the most-affected communities and policy experts in the design of new policies.

- Maximize flexibility for program administrators when crafting legislation for new policies and ensure consistency of funding for new policy investments. Write legislation that provides program administrators with flexibility in how they can determine and validate eligibility and deliver benefits. Avoid creating barriers that require new legislation for routine funding reauthorizations or operational updates.

- Prioritize community outreach and invest in support services to ensure program success. Invest in outreach efforts to build trust and ensure equitable access to programs. Connect families to wraparound services and expand critical support systems that enhance program effectiveness.